Dreaming of owning your own home but struggling because you can't get approved or the loan amount isn’t enough? Don’t lose hope! Co-ฺBorrowing could be the solution that helps you move into your dream home sooner.

Let’s explore who you can co-borrow with!

Who Can You Co-Borrow With?

⬤ Family members with the same last name such as siblings, parents, or children

⬤ Biological siblings even if they have different last names (requires proof, such as a house registration or birth certificate stating the same parents)

⬤ Spouses, whether legally married or not

⬤ LGBTQ+ partners: Co-borrowing is allowed with proof of the relationship, such as a shared house registration, co-owned assets (like a car or property), or joint business documents

Benefits of Co-Borrowing

Co-borrowing doesn't just boost your chances of loan approval — it also helps ease your monthly burden. Plus, all co-borrowers can use the home loan interest for tax deductions!

⬤ Higher Approval Chances: Increase your loan limit and approval likelihood

⬤ Shared Responsibility: Split mortgage payments, typically 50/50

⬤ Tax Benefits: All co-borrowers can claim interest paid on the loan for tax deductions

⬤ Faster Homeownership: Save for a down payment and pay off the loan more easily

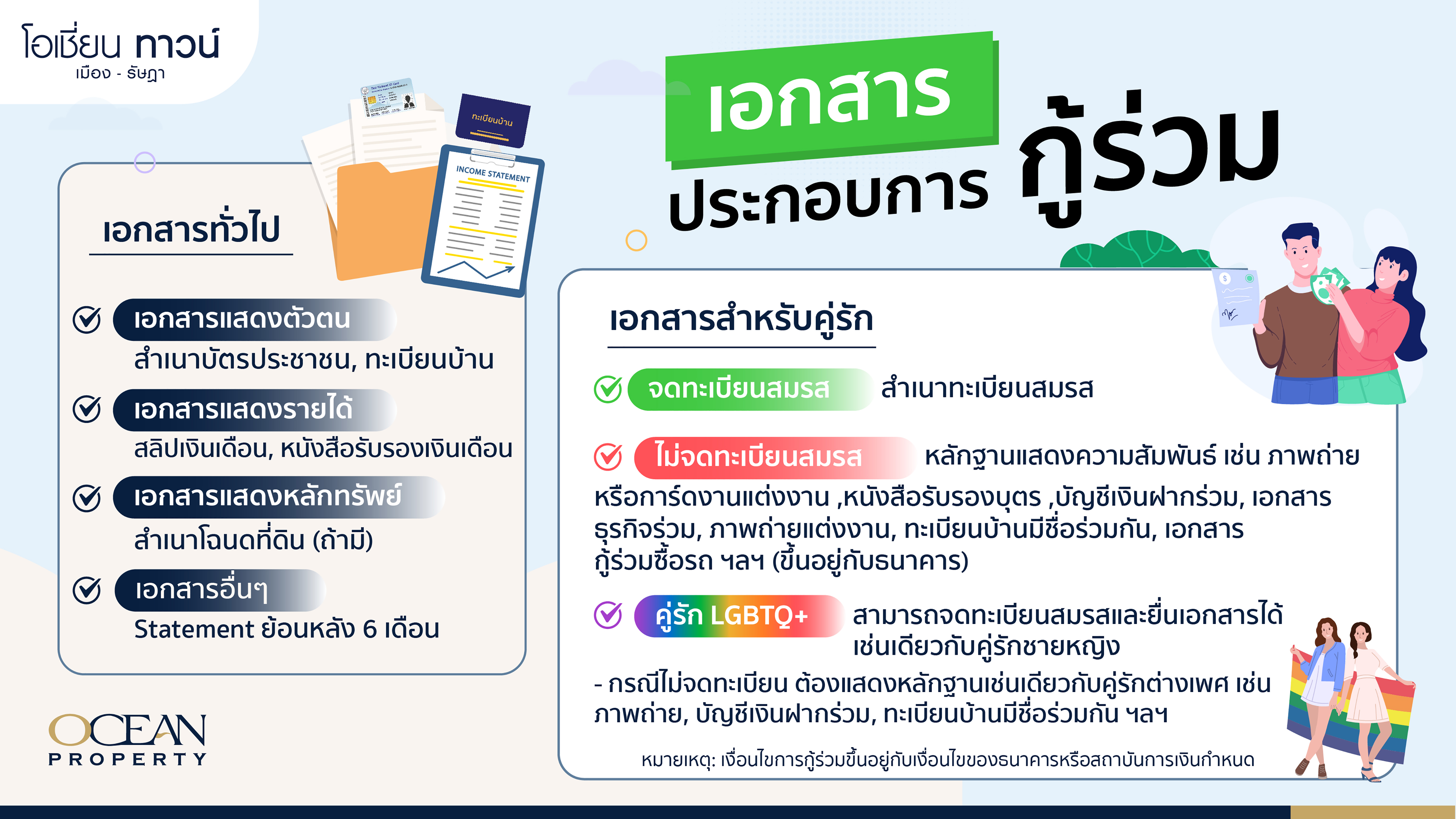

Documents Required for Co-Borrowing

General Documents:

⬤ Proof of identity: Copy of ID card and house registration

⬤ Proof of income: Payslips, employment certificate

⬤ Proof of collateral: Copy of land title deed (if applicable)

⬤ Other documents: Bank statements from the past 6 months

Additional Documents for Couples:

⬤ If married: Copy of marriage certificate

⬤ If not legally married: Provide proof of relationship, such as wedding photos, joint bank accounts, joint property ownership documents, or a shared house registration

For LGBTQ+ Partners:

⬤ If legally married: Same as heterosexual couples

⬤ If not legally married: Provide similar proof of relationship (e.g., photos, joint accounts, shared address registration), depending on the bank's requirements

Co-Borrowing is a great option that helps many people achieve homeownership. However, careful planning and preparation are key to ensuring the process goes smoothly and successfully.

If you’re interested in getting advice on individual or co-borrowing home loans for purchasing a townhouse or commercial building at Ocean Town Muang–Ratsada, Phuket, please contact us at https://m.me/183975518299717?ref=OTColoadweb

Note: Loan approval conditions are subject to the policies of each bank or financial institution.

-

Latest Article

-

Living UpdateOcean Oasis Khon Kaen – Easy to Rent, High Returns

Living UpdateOcean Oasis Khon Kaen – Easy to Rent, High Returns -

Living Update5 Reasons Why Ocean Oasis Khon Kaen is the “Right Condo” for You

Living Update5 Reasons Why Ocean Oasis Khon Kaen is the “Right Condo” for You -

Living Updateโครงการโอเชี่ยน ทาวน์ ภูเก็ต บ้านพร้อมอยู่ ทำไมต้องซื้อในปี 2568 ?

Living Updateโครงการโอเชี่ยน ทาวน์ ภูเก็ต บ้านพร้อมอยู่ ทำไมต้องซื้อในปี 2568 ? -

Living TipsTips to Keep Your Home Cool and Bright Using Natural Energy

Living TipsTips to Keep Your Home Cool and Bright Using Natural Energy

-

-

Relate Article

-

Living TipsTips to Keep Your Home Cool and Bright Using Natural Energy

Living TipsTips to Keep Your Home Cool and Bright Using Natural Energy -

Living TipsTips for Keeping Your Home Free from PM 2.5 Dust – A Clean and Dust-Free Home

Living TipsTips for Keeping Your Home Free from PM 2.5 Dust – A Clean and Dust-Free Home -

Living Tips8 Simple Tips to Keep Your Home Clean and Germ-Free

Living Tips8 Simple Tips to Keep Your Home Clean and Germ-Free -

Living TipsHow to Take Care of Your Home During the Rainy Season

Living TipsHow to Take Care of Your Home During the Rainy Season

-